The school district commissioned a poll to determine interest in a parcel tax for employee compensation. The district will use the results of the $27,000 poll to determine whether they should go forward with an additional parcel tax.

The district is aiming for a November 2018 vote, and surveyed likely November voters from February 5 to 11, with a 4.9 percent margin of error.

The primary purpose of this voter opinion research was “to identify the level of support for a potential $198 parcel tax measure for the November 2018 ballot to support District programs and personnel.”

The key findings: “Although most indicate that maintaining the quality of schools and increasing teacher salaries are worth raising taxes for, fewer than two-thirds see a need for additional funding for local schools.”

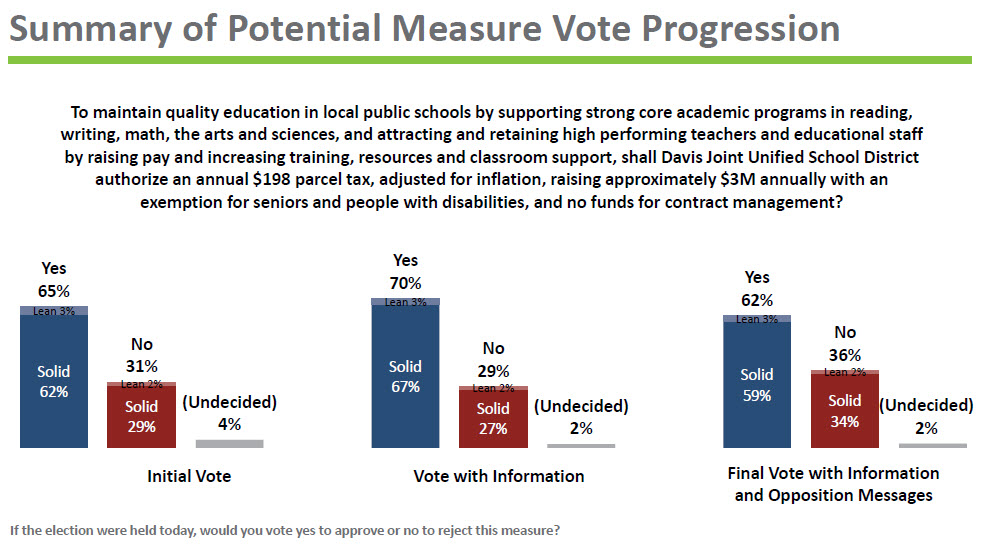

Indeed, the survey found, “Initial support for a parcel tax measure is just shy of the two-thirds threshold in this poll.” However, “Once voters have heard how additional revenue will benefit local schools and students, total support increases.”

However, the pollsters warn, “a measure could be vulnerable to opposition.”

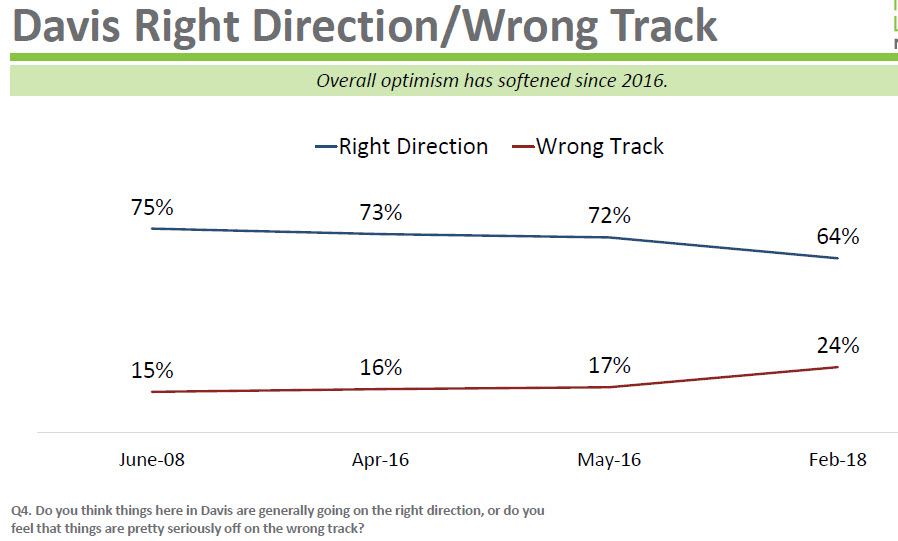

Polling shows that optimism has declined over the last ten years, and strongly since May 2016, going from 72 percent to 64 percent.

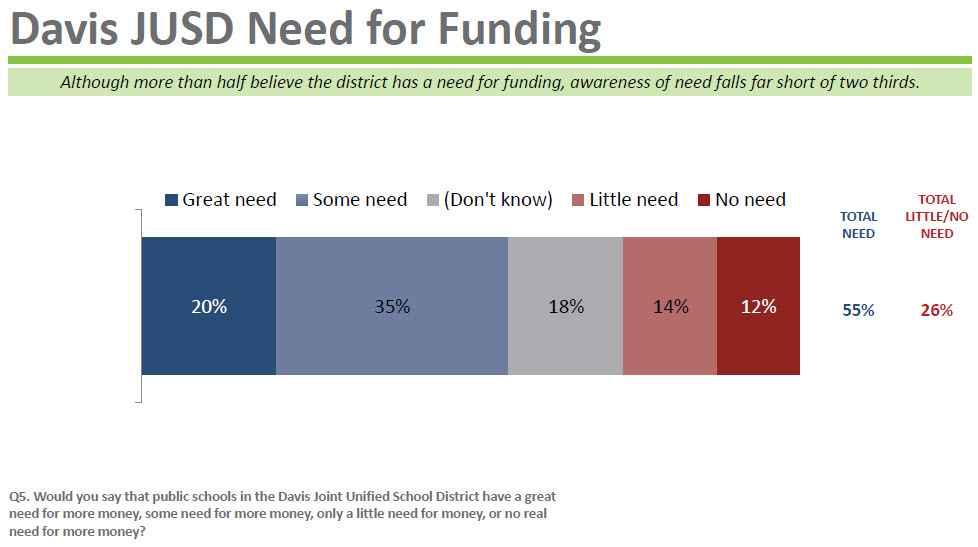

Awareness of the need for funding is only at around 55 percent. That represents a drop from 71 percent in June of 2008. But there was only a one percent drop from April 2016 prior to the passage of the last parcel tax.

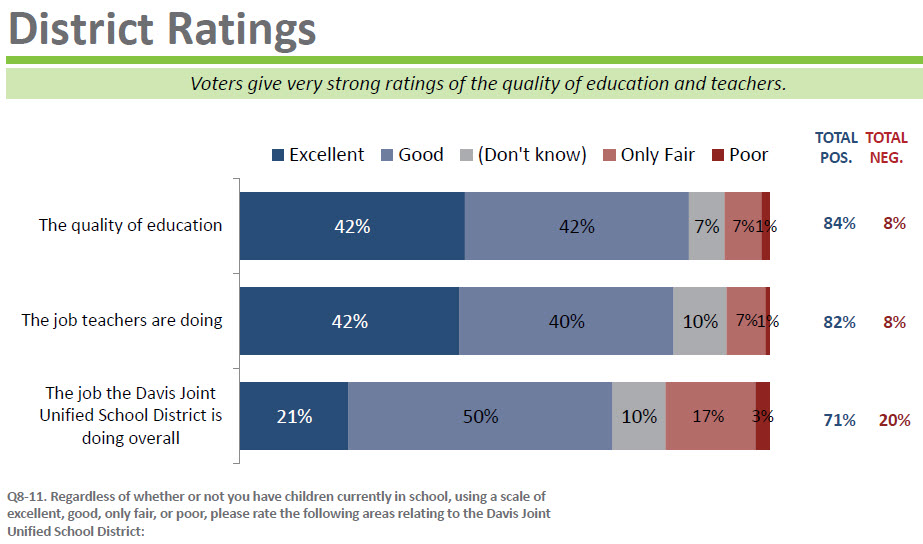

Voters continue to give strong ratings for both the quality of education and the quality of teachers in this school district. The overall job satisfaction has dropped from 80 percent to 71 percent in under two years, but the view of the quality of education has remained steady.

Most voters agree that high quality schools and increasing pay for teachers are priorities. That remains the case, even if it means that the district needs to raise taxes. However, a lesser majority (64 percent) trusts the district to properly manage tax dollars.

Moreover, the voters continue to prioritize maintaining the quality of schools, with a strong 81 percent agreeing that maintaining the quality of the schools should be a top priority even if it means raising taxes. That has largely held steady since April 2016 (when it was 83 percent).

The portion that has fallen somewhat dramatically is the trust in DJUSD to manage tax dollars, which has fallen from 73 percent to 64 percent in just two years.

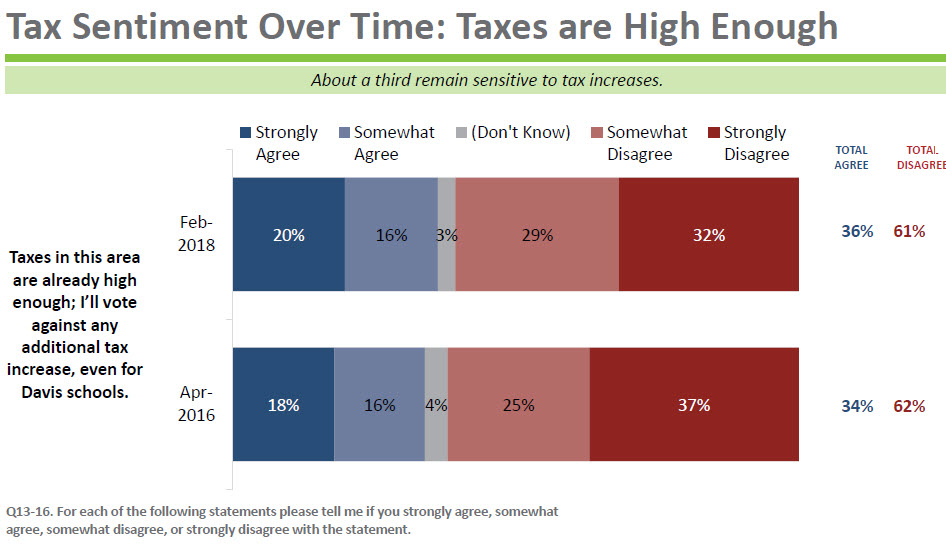

The polling shows the view that “taxes in this area are already high enough” and “I’ll vote against any additional tax increase, even for Davis schools,” is around 36 percent. That is up very slightly, but perhaps significantly from 34 percent in April 2016.

That puts not only the DJUSD Parcel Tax on the bubble but also the potential city parcel taxes as well.

Support for the parcel tax is right below the bubble. They find initially around 62 percent support with another 3 percent lean. With information, that number increases to 67 percent with 70 percent total with leans.

Once they introduce information and the opposition messages, that number drops to 59 percent with another 3 percent lean.

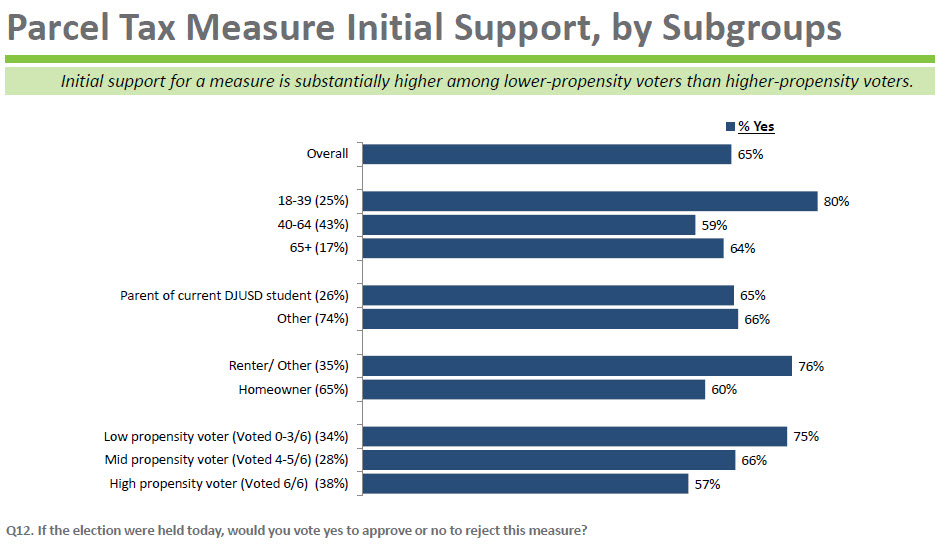

The breakdown is interesting.

In terms of age, the most likely to support the tax are young people under 39. The 40 to 64 range is least likely to support the parcel tax. And those over 65 are at 64 percent support – perhaps due to the senior exemption.

Parents of current students are no more likely to support the parcel tax than anyone else.

Renters are much more likely to support the parcel tax than homeowners – although homeowner support is still at 60 percent.

Finally, the bad news is that the more likely people are to vote, the less likely they are to support the measure.

The top messages for support are:

- All of the revenue from this measure will be spent here in our local schools and cannot be taken away by the state.

- This measure will help attract teachers in positions that are difficult to fill, such as those teaching vocational job skills, special education, bilingual education, and math and science.

- Great teachers are at the center of student achievement. This measure will make sure our schools have the financial resources needed to attract, support, and retain the highest quality teachers.

The pollsters conclude the following.

First, “While poll results indicate that reaching the two-thirds threshold may be challenging, in the right environment, a parcel tax measure on the November 2018 ballot could be successful.”

Second, “Voters are divided about whether the District needs additional funding, and a measure could be vulnerable to vocal opposition.”

Finally, “Ensuring that voters understand how additional revenue would benefit education outcomes for local students would be essential to success.”

The one advantage that the district has in this race is that the teachers’ association has a vested interest to provide the necessary labor and ground forces that could push a close measure over the top.

—David M. Greenwald reporting

The post District to Evaluate Feasibility of Parcel Tax on Thursday appeared first on Davis Vanguard.